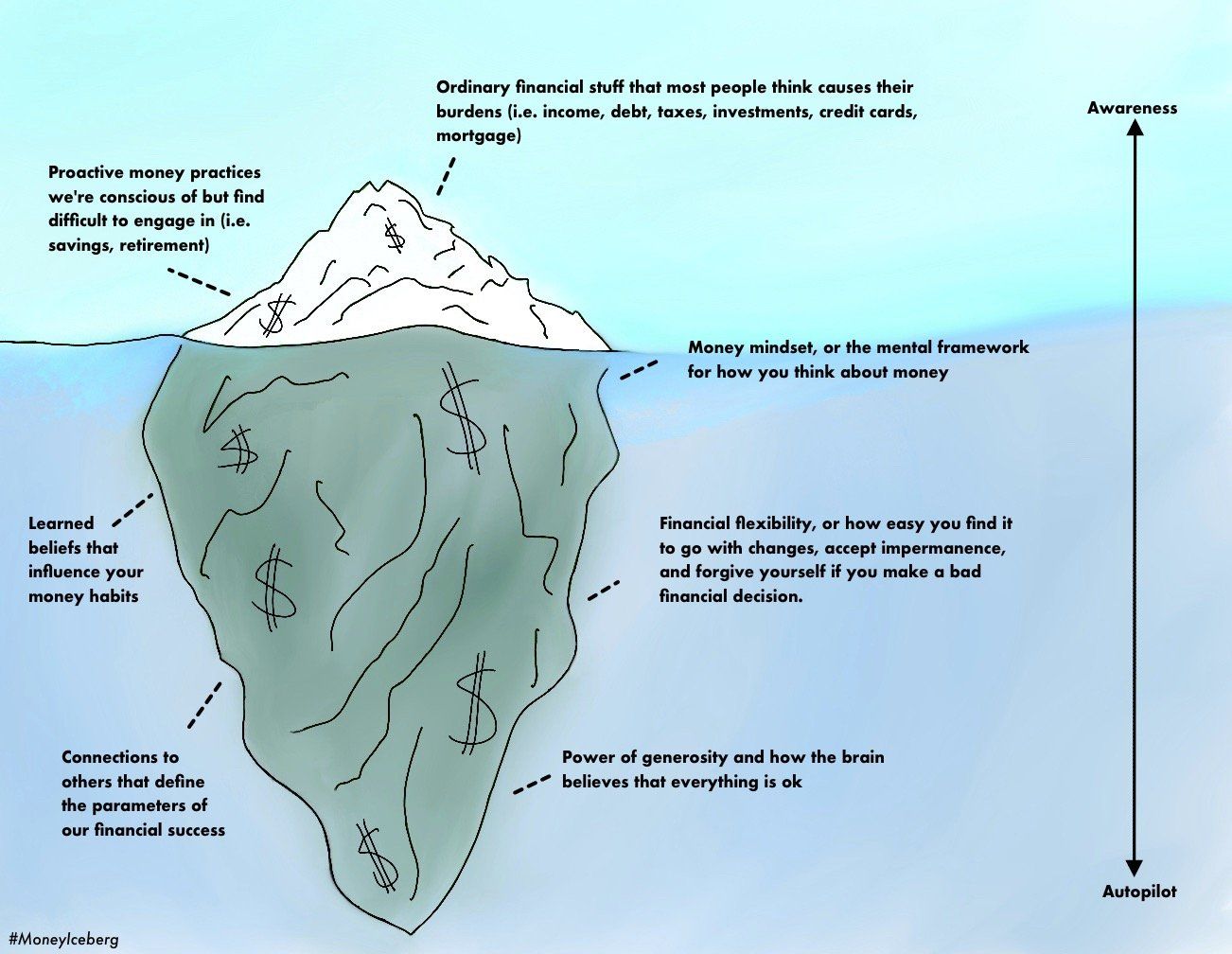

Think of your financial life as an iceberg: no matter how conscious you are of income and bills, debts and investments, the submerged part of yourself—your unconscious money beliefs—is much greater still.

In my thirty-five years as a financial advisor, I’ve seen too many people only pay attention to what’s above the waterline, which is limiting because it’s the submerged part that really drives our financial success and ease.

When we understand the depths of our financial lives, we can begin to change any financial situation we find ourselves in.

Let's take a look at the “iceberg” of your financial life:

Your Conscious Money Beliefs: What We See is Only the Beginning

The part above the waterline is the ordinary financial matters that most people think is the cause of their burdens—income, debt, taxes, investments, credit cards, mortgage, and so on.

Much of this relates to spending, which also happens to be the aspect of finances that most people think of when they think of money, including how much they would like to have to spend in the future.

However, spending isn’t just a reflection of material goods. It’s also a reflection of habits.

So while most think spending is the most important aspect of money, it’s only the tip of the iceberg. Because our financial habits are really influenced by everything below.

At the waterline are our proactive money habits, such as savings and retirement plans. While we’re generally conscious of the need to save for the future, many find it difficult. What’s more, most people also think that if they have savings, their financial lives will be taken care of… a done deal… and they won't have to think of worry about money again.

Unconscious Money Beliefs Control Our Financial Decisions

But this way of thinking is perilous as it ignores the influences of everything else below the waterline—such as your money mindset, which is the mental framework for how you think about money.

When we adopt a positive money mindset, we see ourselves as enough, no matter how little we have. In turn, this will put us in the frame of mind needed to make even more money.

However, a negative money mindset always tell us to strive for more, more, more… which, in turn, makes us feel as if we can never be enough no matter how much we have saved in the bank.

Where does your money mentality come from?

Your fixed and frequently unconscious money beliefs.

Beliefs are where we start to understand the influence others have on us and our relationship to money. They're where we can see the lessons we were taught by others when we were young.

In your family of origin, was wealth something to aspire to? Or to eschew at all costs? Did you believe that rich people were happier than you… or that you were destined at birth to be rich or poor?

Beliefs can propel you to success or limit it. And changing your beliefs can change your life.

Creating New Money Beliefs Unleashes Your Financial Wisdom

Your capacity to change something so fundamental about how you see the world will depend on an even deeper part of the iceberg of your financial life: your financial flexibility.

How easy do you find it to go with changes, accept impermanence—and, most of all, forgive yourself if you make a bad financial decision?

While nearly every aspect of money is thought of in individual terms (from the single penny to the dream of personal wealth), money simply cannot be gained without the cooperation of others.

Our connections to others and our ability to discuss money (and make money) with them is what defines the parameters of our financial success.

Being connected to others isn't just how we gain money. It's how we're able to participate in one of the most powerful financial practices around: generosity.

Generosity isn't a last resort or something we should only consider when we’ve reached our dreams. Generosity is one of the few things that has the power to mitigate feelings of anxiety and fear.

It doesn't matter how much you give—the action of giving starts tricking the brain into believing that you have enough, that you're okay, that you can relax. Why? Essentially it’s a trick your mind plays on itself (though a beneficial one). The simple act of giving alerts the brain that you must have something of value… otherwise you would have nothing to give.

Our prosperity quickly suffers if anything is amiss with the “iceberg” of our financial lives.

Unhealthy financial lessons we learned early in life may manifest as destructive autopilot behaviors. Financial inflexibility might make us prone to missing opportunities that could bring us greater wealth. Or a poor money mindset might allow us to succumb to compulsions that hurt our bottom line.

-

If you’d like more insight into your money beliefs, why not get a free preview of my online course?

Your Inner Compass: Financial Wisdom on the Road to Enough helps you unleash your money wisdom and develop tools to create your own financial destiny.

SHARE THIS POST

The road to financial freedom is easier when you share the journey. By signing up for Spencer’s newsletter, you’re joining a growing community of people who’ve found their way to “Enough.”